Sales tax calculation formula

Estimate your state and local sales tax deduction. In this condition you can easily calculate the sales tax by multiplying the price and tax rate.

Tip Sales Tax Calculator Salecalc Com

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. California has a 6 statewide sales tax rate but also. Select By Formula in the How are sales taxes calculated for field. To set up a tax calculation formula.

Calculate the sales tax on the washing machine. Get a 30-Day Free Trial of Xero. Get Your Quote Today with SurePayroll.

Sales Tax gross profit cost of goods sold gross profit cost of goods sold sales tax rattle. To meet the tax requirement you would do the following. Get Started Today with 2 Months Free.

Sales Tax Rate s c l sr. See If You Qualify. Fast Processing for New Resale Certificate Applications.

Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable. Sales Tax Calculation Examples. Ad Fast Online New Business Calculating Sales Taxes.

Before-tax price sale tax rate and final or after-tax price. As the Sales Tax Formula illustrates there. An example of this type of calculation is a state sales tax of 1 percent applied to the first 65 percent of the sales amount.

Use the drop-down liston the Which amount should be. C County Sales Tax Rate. Avalara Will Calculate Tax and File Your Returns in 24 States for Free.

Ad Connect DAVO To Your Point-Of-Sale Software. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. See If You Qualify.

All Services Backed by Tax Guarantee. Sales Tax Deduction Calculator. Select an item sales tax group.

A washing machine is marked for sale at 16600 inclusive of sales tax at the rate of 10. Click the Formula designer button. The simplest way to calculate sales tax is to use the following equation.

Never Worry About Sales Tax Again. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable.

Select the cell you will place the calculated result enter the formula B1B2 B1 is the price exclusive. Press CTRLN on the Calculation tab to define the calculation expression for a specific sales tax code. Calculate tier 1 tax by multiplying the limit 10000 by the tier 1 tax 6.

Avalara Will Calculate Tax and File Your Returns in 24 States for Free. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. Answer a few questions about yourself and large.

Get Financial Visibility Grow Your Small Business With Xero. L Local Sales Tax Rate. S State Sales Tax Rate.

Sr Special Sales Tax Rate. Hassle Free Sales Tax. The Small Business Owners Best Friend.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Calculate tier 2 tax by subtracting the limit from the amount and multiplying the result by the tier 2 tax rate 10. Ad Ease the Burden Stress of Accounting Bookkeeping.

The Top How Do I Calculate Sales Tax From A Total

Find Sales Tax And Total Amount Youtube

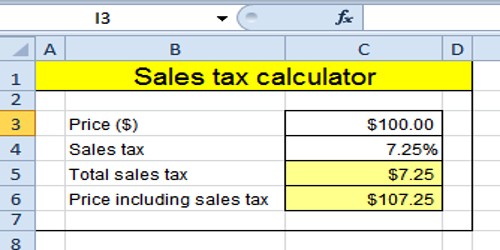

How To Calculate Sales Tax In Excel

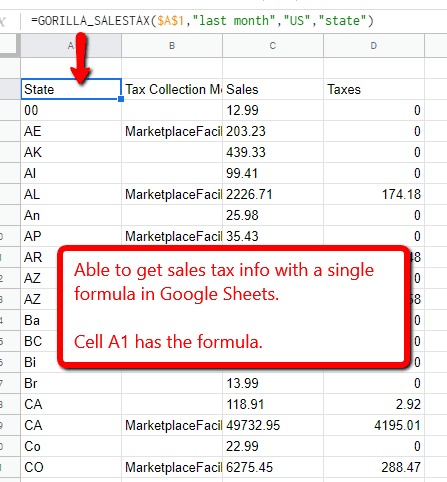

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

Ex Find The Sale Tax Percentage Youtube

Sales Tax Lesson For Kids Study Com

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax On Almost Anything You Buy

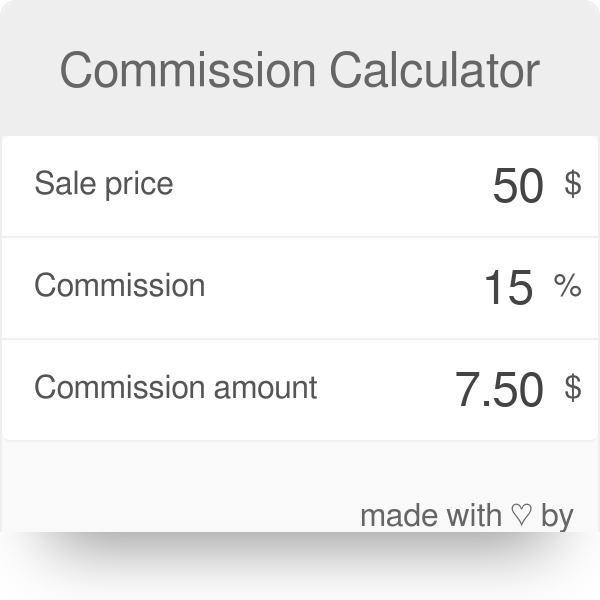

Commission Calculator

Excel Formula Two Tier Sales Tax Calculation Exceljet

Reverse Sales Tax Calculator

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

How To Calculate Sales Tax Definition Formula Example

Sales Tax Calculator

Calculation Of Sales Tax Assignment Point

Mathematics For Work And Everyday Life